Replace your escrow with M&A insurance

Escrow agreements are commonly found in M&A transactions and they play an important role in facilitating deals.

Typically, 10 to 20 percent of the purchase price of a business is held by a third party to protect the buyer against any future losses due to a breach of representation or warranty by the seller.

However, with escrow the seller’s proceeds can often be tied up for months or even years and this leaves them vulnerable to unknown risks post-deal. It can also be particularly frustrating for sellers who are looking to re-invest their proceeds, but can’t access them for a prolonged period.

Many small business sellers are unaware that M&A insurance now exists to not only offer them peace of mind, but also to help them avoid the need for an escrow.

Here’s how M&A insurance can work to replace the need for escrow on your deal:

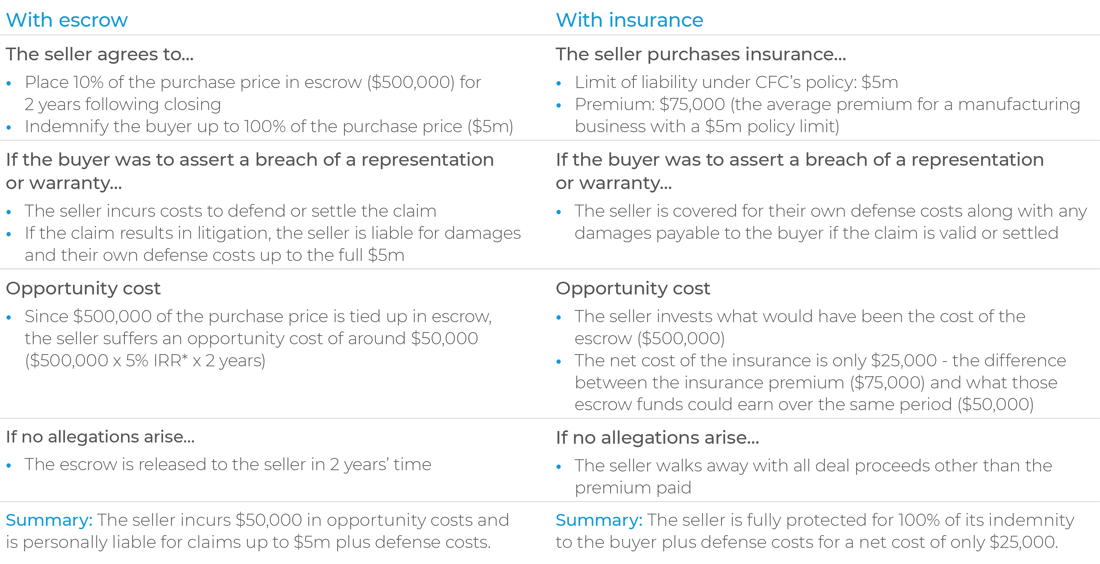

The seller of a manufacturing business has agreed to sell the business for $5m. The buyer is paying cash, and the purchase and sale agreement indicates that the seller is required to indemnify the buyer for representations and warranties up to the full value of the business.

M&A insurance should be seen as a highly beneficial alternative to escrow agreements in M&A deals. Not only does it help eliminate the need for an escrow which allows sellers to invest funds that are otherwise inaccessible, it also protects sellers from the multitude of risks present in M&A transactions.

If you have any questions regarding M&A insurance for business sellers, please contact the transaction liability private enterprise team at tlpe@cfc.com.

*Internal rate of return (IRR) is used to determine the profitability of potential investments.