Mergers and acquisitions: Why target businesses need standalone IP insurance

Merger and acquisition (M&A) transactions are often a catalyst for target businesses to consider their exposure to intellectual property (IP) legal risk.

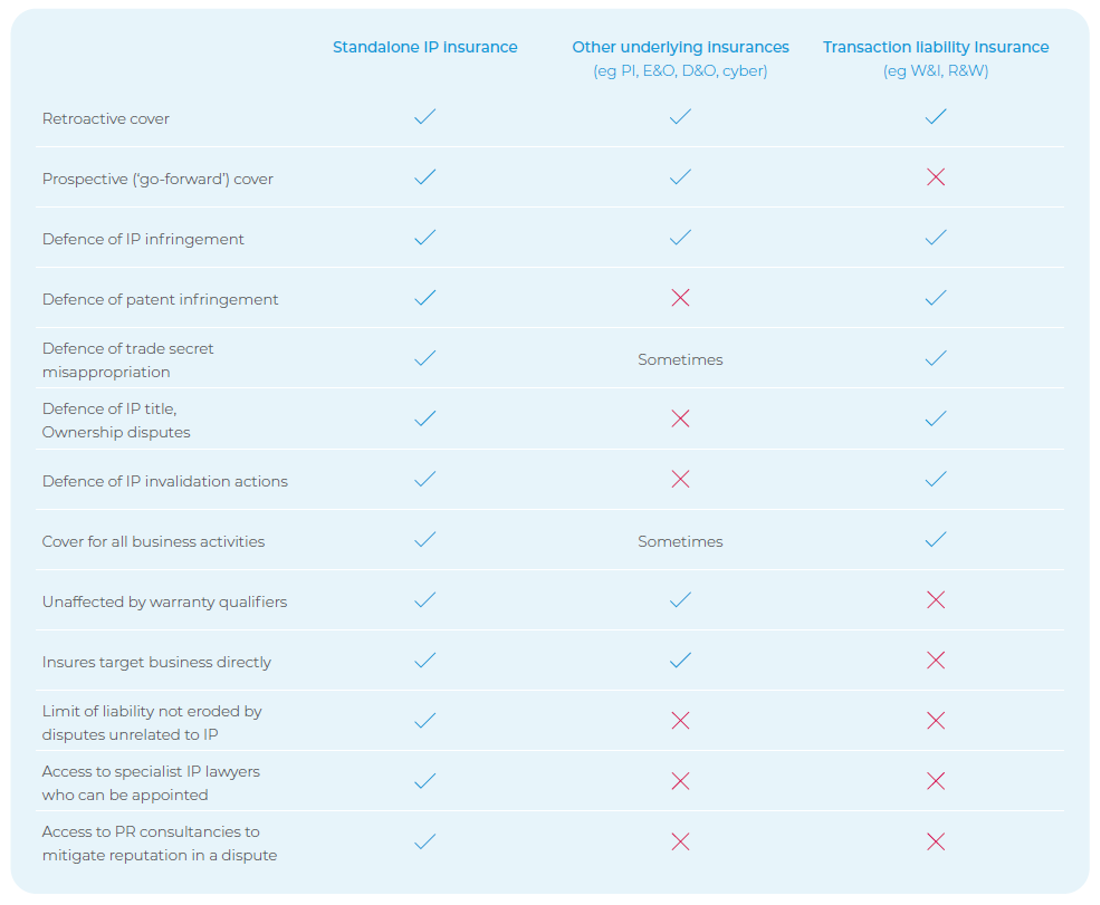

Target businesses often rely on a combination of underlying insurance and transaction liability insurance to cover their IP legal risks, but only a standalone IP insurance policy can provide comprehensive cover.

Underlying insurance: Target companies will have a number of commercial insurance policies in place which often contain some coverage for IP risk.

Transaction liability insurance: A policy covering the breach of representations and warranties in the purchase agreement will contain coverage for IP risk.

How are underlying insurances limited?

IP infringement cover is a common part of many commercial liability insurance policies and is often included as an insuring clause. However there are some common limitations with this type of IP coverage provided.

- Patent infringement is often not covered: Patent infringement is important because patents exist in every technology area and industry sector, so restrictions or exclusions in this area can cause issues.

- Trade secrets misappropriation is often not covered: Trade secrets are common in technologies and industry sectors. Trade secrets misappropriation is an exposure that is often limited or excluded from commercial liability policies.

- IP title and IP validity are not covered: The defence and the outcome of IP title or IP validity disputes can be critical to the value of a business, but it is not common for disputes to be covered on a commercial liability policy.

How is transaction liability insurance limited?

Transaction liability policies cover the representations and warranties in a purchase agreement relating to IP title, IP validity and IP infringement. There are some common limitations to the extent of IP coverage available, as well as limitations on the benefits of transaction liability insurance to a target business.

Direct insurance coverage

In order for a claim to trigger transaction liability insurance, proof of a breach of the relevant representation or warranty must be given. This process can be complicated and is also a step removed from the underlying dispute. Direct insurances, by contrast, are triggered at the point the policyholder receives an allegation from a third party. The claims handlers can also provide a service to assist the policyholder to access and appoint a specialist lawyer with relevant experience.

‘Go-forward’ IP risk

It is not customary for transaction liability insurance to cover the prospective, (or ‘go-forward’), activities of a target business. This is a significant limitation because there are many ways in which IP exposures arise after the closing of a transaction:

New business activity

After a transaction closes, the launch of any new products, services, or new features to existing products is a new exposure. Transaction liability insurance policies, which only insure retroactive activity, would not usually cover IP disputes relating to these new business activities.

New territories

IP rights are granted nationally. This has implications relating to the sale of products and services: a product can be sold in one country without infringing IP rights, but that same product could be alleged to be infringing IP in another country. If a product is sold in a new country for the first time after a transaction closes, it is a new exposure that would not usually be covered on transaction liability insurance policies.

New IP rights

IP is invented every single day. A new IP right owned by a third party which was granted after a transaction closed is a new exposure. Transaction liability insurance policies would not usually provide IP infringement cover against third party IP rights granted after the close of a transaction.

Did you know?

Each year over 1 million new patents are granted, and over 10 million new trademarks are filed worldwide - World Intellectual Property Organization data

The benefits of a standalone IP policy

Standalone IP insurance is the most comprehensive IP risk transfer product available. Businesses undergoing M&A should consider purchasing standalone IP insurance to cover the greatest amount of IP legal risk. Check out the coverage and benefits of IP insurance compared to other types of insurance:

Why insure M&A targets for IP with CFC?

- No proposal form

- No underwriting call

- Free binding quote

- Quotes in under 48 hours

Get a quote

It’s easy to get a quote from CFC’s IP team. All you need to do is email ip@cfc.com with the following information:

- Target’s revenue information

- Deal summary:

- Transaction value

- Buyer & target

- Purchase type

- Percentage change in ownership

If you have any questions about standalone IP insurance within an M&A, or any questions about IP insurance in general, please email ip@cfc.com